The Internal Revenue Service challenged deferred exchange but the Tax Court was liberal in allowing them and in 1991 the Internal Revenue Service adopted Regulations permitting them and governing their structure.

Deferred exchanges are often called “Starker” exchanges. U.S. taxpayers were permitted to structure deferred exchanges in which the taxpayer sold the Relinquished Property to a buyer and acquired Replacement Property from a seller using the Realized Proceeds. Following the decision in 1979 in Starker v. Section 1031 on its face appears to permit only a direct exchange of properties between two taxpayers. It remains identical with only two additions in more than 75 years. Section 1031 has existed in the Internal Revenue Code since the first Code in 1939.

Section 1031 provides that “No gain or loss shall be recognized if property held for use in a trade or business or for investment is exchanged solely for property of like kind." The first provision of a federal tax code permitting non-recognition of gain in an exchange was Code Sec. A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings.

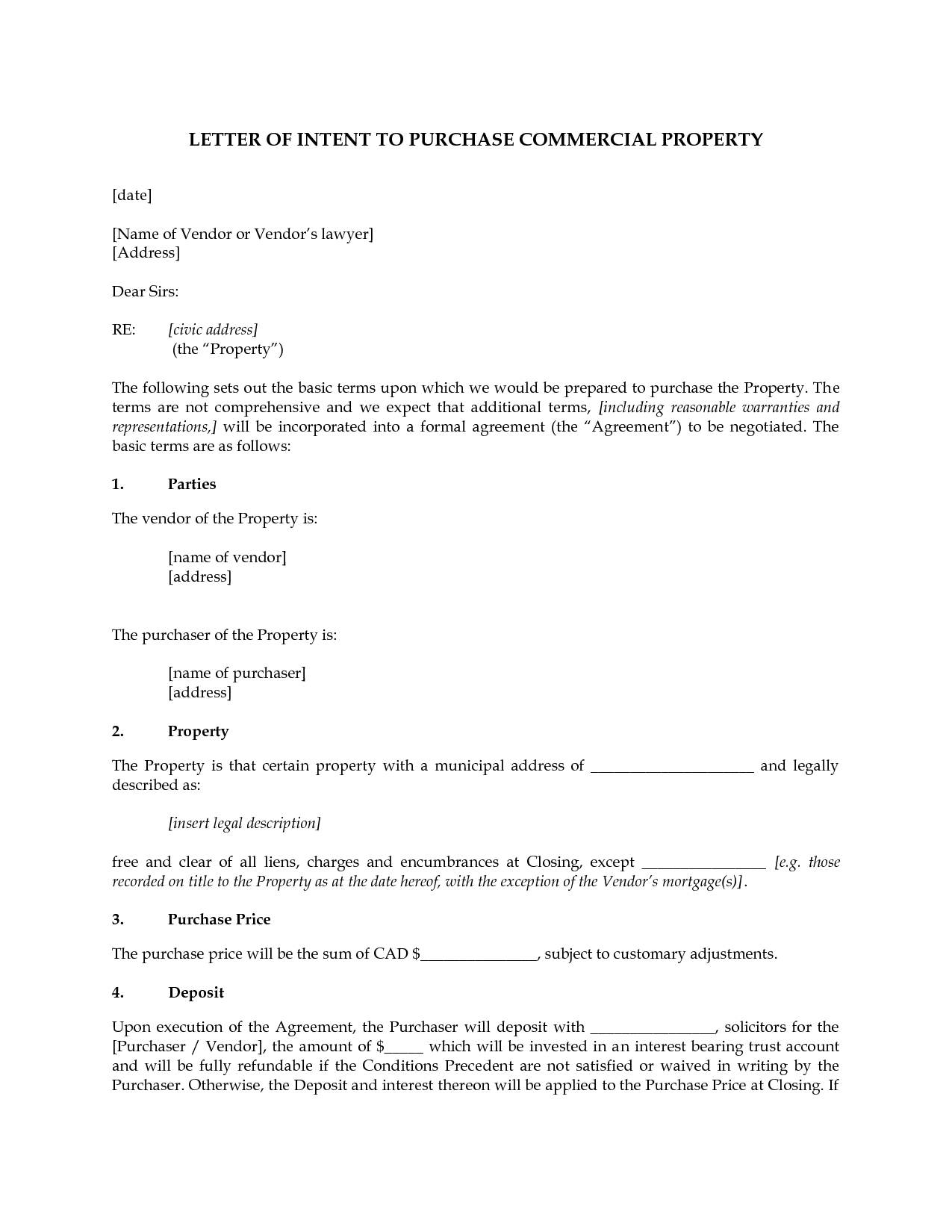

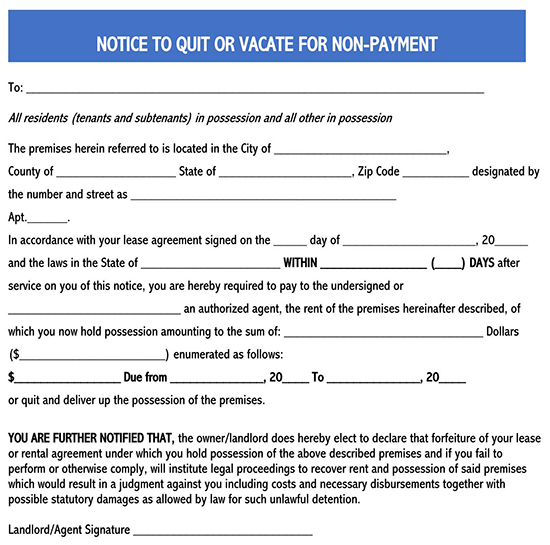

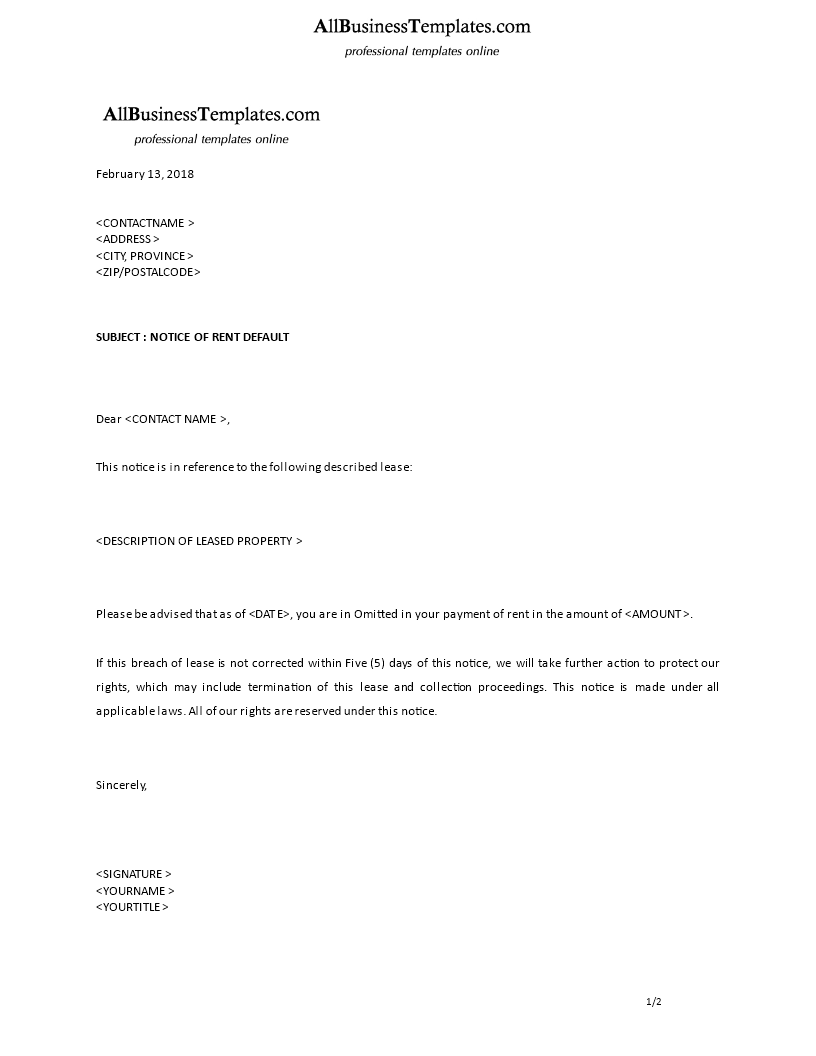

Documents evidencing and securing the loan typically include: loan agreements, promissory notes, mortgages or deeds of trust, assignments of rents and leases, financing statements, environmental indemnity agreements, guaranties, subordination, non-disturbance and attornment agreements, estoppel certificates, and other ancillary documents.Īn exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement property. Assets used to collateralize commercial finance loans, aside from the real estate, may include fixtures, equipment, bank and/or trade accounts, receivables, inventory, general intangibles, and supplies. Commercial financing loans are secured primarily by real estate and related assets owned by the debtor. Financing for non-residential real estate is generally obtained from a bank, insurance company or other institutional lender to provide funds for the acquisition, development, and operation of a commercial real estate venture. Financing a property is the standard method by which individuals and businesses can purchase residential and commercial real estate without the need to pay the full price in cash up front from their own accounts at the time of the purchase.

0 kommentar(er)

0 kommentar(er)